Essential Safety Tips for Staying Safe Over the Road

Essential Tips Every OTR Driver Needs to Stay Prepared and Secure

For over-the-road (OTR) drivers, safety is a daily concern, as you never know what hazards or unexpected situations you may encounter. From severe weather to breakdowns and unfamiliar locations, preparation is essential to keeping yourself and your cargo safe on the road. Here are some valuable safety tips every truck driver should know to stay prepared, alert, and resilient, no matter where the journey takes you.

1. Prepare for Severe Weather

Weather can turn quickly, and being prepared for severe conditions like snow, rain, wind, and extreme temperatures is essential.

- Stay Updated with Weather Apps: Check weather forecasts for your route daily. Apps such as AccuWeather or Weather Radar help you stay informed about current and forecasted conditions.

- Have Essential Supplies Onboard: In bad weather, keeping supplies like blankets, a change of warm clothes, extra food, and water will help you handle any unexpected delays or stops.

- Avoid Flooded Roads: Driving through flooded areas is extremely dangerous, as water may hide washed-out road surfaces. If there is heavy rain, park in a safe location until conditions improve.

2. Maintain Vehicle Safety and Emergency Supplies

Keeping your vehicle in top shape and having an emergency kit can make a big difference in handling unexpected roadside situations.

- Regular Inspections: Regularly check tires, brakes, lights, fluids, and essential equipment. If something needs attention, address it immediately rather than risking it worsening on the road.

- Emergency Kit Essentials: Pack items like a first aid kit, fire extinguisher, road flares, and tire repair supplies. Tools for basic repairs, such as a wrench, jumper cables, and an emergency window-breaking tool, are invaluable.

- Emergency Food and Water: Non-perishable foods like protein bars, canned goods, and bottled water can be lifesavers if you get stranded or delayed. Keeping a portable stove or heating tool is also a good idea for longer routes in remote areas.

3. Plan Your Rest Stops Wisely

Choosing safe, reliable stops is essential to staying secure and rested.

- Secure Locations: Rest areas and truck stops with good lighting and security features should be prioritized over remote or dimly lit areas.

- Plan Ahead: Familiarize yourself with safe locations along your route where you can stop and rest. Apps like Trucker Path help you locate trusted truck stops and rest areas.

- Avoid Overnight Stops in Unknown Areas: If possible, plan your route so that you’re stopping in well-known locations instead of random roadside areas. Safety in familiar settings is always preferable.

4. Maintain Situational Awareness

Staying aware of your surroundings is one of the best ways to prevent incidents.

- Observe Your Surroundings: Be mindful of unfamiliar or suspicious activity near your truck, especially in parking lots, truck stops, and rest areas. If something feels off, trust your instincts and find a safer location.

- Limit Unnecessary Stops: When feasible, limit the number of stops you make, especially in remote areas. If you must stop, avoid leaving valuables or cargo exposed, and lock your vehicle every time.

- Stay Connected: Let someone know your route and anticipated arrival times, whether it’s your dispatcher, a family member, or a friend. Checking in can make all the difference in an emergency.

5. Use Technology for Safety

Take advantage of technology to monitor road conditions, stay connected, and remain aware of hazards.

- GPS and Traffic Apps: Use GPS with live traffic updates to stay informed about accidents, road closures, or hazardous conditions ahead. Apps like Waze offer real-time updates from other drivers.

- Communication Devices: Equip yourself with reliable means of communication. A CB radio or a backup phone charger can be invaluable in areas with poor cell service.

- Emergency Response Apps: Apps like Red Cross’s Emergency app or FEMA’s disaster response app offer tools for handling emergencies and provide location-based alerts about severe weather or disasters.

6. Stay Prepared for Breakdowns

Breakdowns are inevitable for any OTR driver, so having a plan and the right tools is essential.

- Routine Maintenance: Regular vehicle maintenance, such as oil changes and brake checks, can minimize the risk of breakdowns.

- Know Who to Call: Have a list of roadside assistance contacts along your route. Knowing which services are available nearby can be a lifesaver if you’re stranded.

- Stay Visible: Use hazard lights and place reflective triangles or road flares around your truck if you must stop on the shoulder. This increases visibility for oncoming traffic and reduces the risk of a collision.

7. Protect Against Theft and Cargo Tampering

Cargo theft is a risk in many areas, especially high-traffic or remote locations.

- Use Anti-Theft Devices: Equipment such as steering wheel locks, wheel chocks, and trailer door locks can discourage would-be thieves.

- Park Smart: Whenever possible, park in well-lit, secure areas and back up your truck against a wall or other immovable structure, which can make it harder for thieves to access your cargo.

- Be Discreet About Your Load: Avoid discussing your cargo details publicly. If thieves are aware of valuable goods onboard, it increases the risk of theft.

8. Focus on Health and Rest

Your well-being on the road is crucial to your safety.

- Get Enough Sleep: Fatigue is one of the top causes of truck accidents. Take regular breaks, and don’t skip sleep to make deadlines. Being well-rested is essential for focus and decision-making.

- Eat Well and Stay Hydrated: Good nutrition and hydration improve energy levels and help you stay alert. Pack nutritious snacks like nuts, fruit, and jerky for quick, healthy options on the road.

- Exercise During Stops: Stretching and short walks during breaks reduce fatigue and help prevent back pain and muscle stiffness from prolonged sitting.

9. Have a Safety Mindset

In high-stress or emergency situations, a calm, focused mindset is invaluable.

- Mentally Rehearse Scenarios: Think through “what if” scenarios and have a plan. Preparing mentally helps you react faster and more effectively if an emergency arises.

- Know Your Limits: Listen to your body, and never push yourself to keep driving if you feel exhausted, sick, or unsafe.

- Trust Your Instincts: Your instincts are often your best guide. If something feels unsafe, it probably is—don’t ignore your gut feelings.

In Summary

Staying safe on the road involves preparation, awareness, and caution. By keeping your vehicle in good shape, planning your stops carefully, and prioritizing your personal well-being, you’re setting yourself up for a safer and more enjoyable journey. Preparation is key, so take the time to implement these safety practices on your next route.

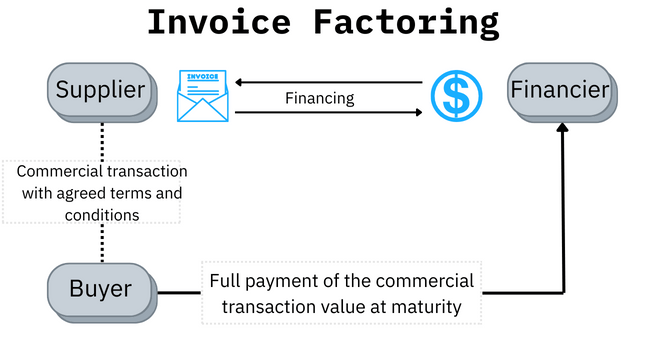

Need support while you’re on the road? Our factoring services can help you manage your finances seamlessly, allowing you to focus on what matters most—staying safe and delivering your loads efficiently. Reach out to learn more about how we can support you and keep you moving forward!

VISIT US

HOURS

Monday - Friday

8:00am - 5:00pm MST

Closed All Major Holidays

We provide working capital to businesses in all 50 states.

Share On: