Navigating Legal and Compliance Challenges in the Staffing Industry

Legal Challenges and Solutions for the Staffing Industry

The staffing industry is a dynamic and essential sector that connects businesses with the talent they need. However, it is also one of the most legally complex industries, subject to a wide array of laws and regulations that can pose significant challenges for staffing agencies. From labor laws to worker classification, staying compliant is crucial for avoiding legal pitfalls and ensuring smooth operations. This guide will help you navigate the key legal and compliance challenges in the staffing industry.

Overview of Key Legal and Regulatory Issues Affecting the Staffing Industry

Staffing agencies must contend with numerous legal and regulatory issues, many of which vary by jurisdiction. Here are some of the most critical areas:

1. Employment Laws: Staffing agencies must comply with federal, state, and local employment laws. This includes the Fair Labor Standards Act (FLSA), which governs minimum wage, overtime pay, and child labor; the Family and Medical Leave Act (FMLA); and the Occupational Safety and Health Act (OSHA).

2. Worker Classification: Misclassifying workers as independent contractors instead of employees is a common and costly mistake in the staffing industry. The consequences of misclassification can include back taxes, penalties, and legal disputes.

3. Anti-Discrimination Laws: Compliance with anti-discrimination laws, such as Title VII of the Civil Rights Act, the Americans with Disabilities Act (ADA), and the Age Discrimination in Employment Act (ADEA), is crucial. Staffing agencies must ensure that their practices do not lead to discriminatory outcomes.

4. Immigration Compliance: Staffing agencies must adhere to immigration laws, including verifying employment eligibility through the I-9 process and complying with the E-Verify system where applicable.

5. Wage and Hour Compliance: Ensuring that workers are paid accurately and on time, including overtime wages, is essential to avoid wage and hour disputes.

Tips for Staying Compliant with Labor Laws and Regulations

Compliance with labor laws and regulations requires a proactive and informed approach. Here are some tips to help your staffing agency stay compliant:

1. Stay Informed About Legal Changes: Labor laws and regulations frequently change. Subscribe to industry newsletters, attend legal seminars, and consult with legal professionals to stay updated on the latest developments.

2. Implement Clear Policies and Procedures: Develop and enforce clear policies and procedures that align with legal requirements. This includes guidelines for worker classification, wage and hour compliance, anti-discrimination practices, and safety standards.

3. Conduct Regular Audits: Regular internal audits can help identify compliance gaps and correct them before they lead to legal issues. Focus on areas like payroll, worker classification, and documentation practices.

4. Provide Ongoing Training: Ensure that your team is well-trained on the latest laws and regulations. Regular training sessions can help employees understand their responsibilities and how to implement compliance measures effectively.

The Impact of Changing Employment Laws on Staffing Practices

Employment laws are constantly evolving, and these changes can significantly impact staffing practices. For instance, recent developments in gig economy regulations and worker classification laws have created new challenges for staffing agencies.

1. Worker Classification Rules: Laws such as California's AB 5 have redefined the criteria for classifying workers as independent contractors versus employees. These changes require staffing agencies to re-evaluate how they classify their workers and make adjustments as needed.

2. Paid Leave Requirements: As more states and localities introduce paid sick leave and family leave laws, staffing agencies must adapt their policies to ensure compliance. This can involve adjusting payroll systems and revising contracts to reflect these new obligations.

3. Minimum Wage Increases: As states and cities implement higher minimum wage rates, staffing agencies must ensure that their wage practices comply with the highest applicable rate. This may require renegotiating client contracts and adjusting billing rates.

Best Practices for Handling Contracts, Worker Classification, and Payroll

Managing contracts, worker classification, and payroll are central to maintaining compliance in the staffing industry. Here are some best practices to follow:

1. Use Clear and Comprehensive Contracts: Contracts should clearly outline the terms of employment, including wage rates, job duties, and duration of employment. Ensure that contracts are compliant with applicable laws and that both parties fully understand the terms.

2. Accurately Classify Workers: Use the appropriate tests (e.g., the IRS 20-factor test or the ABC test) to determine whether a worker should be classified as an employee or an independent contractor. Err on the side of caution and seek legal advice if there is any uncertainty.

3. Maintain Accurate Payroll Records: Ensure that your payroll system is accurate and up-to-date. This includes tracking hours worked, overtime, and deductions accurately. Regularly audit payroll records to catch any discrepancies early.

4. Consult Legal Experts: Regular consultation with legal experts can help you navigate complex compliance issues. They can provide guidance on contract language, worker classification, and other legal matters.

Advice from Legal Experts on Avoiding Common Pitfalls

Legal experts in the staffing industry offer the following advice to avoid common pitfalls:

1. Document Everything: Keep detailed records of all employment-related transactions, including contracts, time sheets, and communications. Documentation is your best defense in the event of a dispute.

2. Be Proactive About Compliance: Don’t wait for a legal issue to arise before addressing compliance concerns. Regularly review your policies and procedures to ensure they align with current laws.

3. Engage in Risk Management: Identify potential areas of legal risk in your operations and take steps to mitigate them. This could involve revising contracts, implementing new training programs, or investing in compliance software.

4. Seek Tailored Legal Advice: Each staffing agency is unique, and legal requirements can vary based on location, industry, and client base. Consult with an attorney who specializes in staffing law to receive advice tailored to your specific situation.

Navigating the legal and compliance challenges in the staffing industry can be daunting, but with the right approach, your agency can operate smoothly and avoid costly legal pitfalls. By staying informed, implementing best practices, and seeking expert advice, you can ensure your business remains compliant and successful in an ever-changing legal landscape.

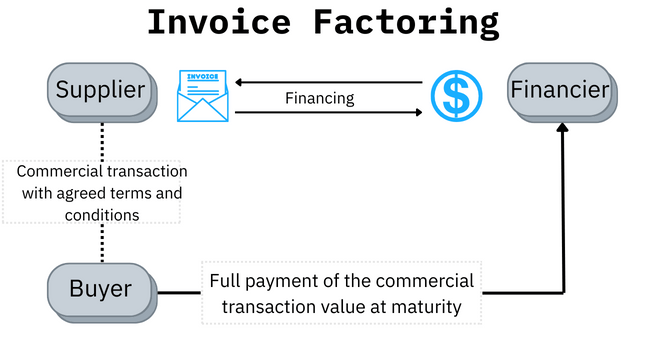

Looking for a financial partner that understands the complexities of the staffing industry? At Atlas Factoring, we specialize in providing factoring solutions tailored to staffing agencies. Contact us today to learn how we can help your business thrive while staying compliant with industry regulations.

VISIT US

HOURS

Monday - Friday

8:00am - 5:00pm MST

Closed All Major Holidays

We provide working capital to businesses in all 50 states.

Share On: