How to Find Affordable Parking for Truckers

Tips for Saving Money and Staying Safe while finding Parking

For truckers, finding affordable and safe parking can feel like searching for a needle in a haystack. Whether you're taking your mandated rest break, waiting for your next load, or wrapping up your workday, parking expenses can quickly add up. On top of that, the shortage of truck parking spots in many areas only adds to the challenge.

In this blog, we’ll cover practical tips to help you secure affordable parking without compromising safety or convenience

.

1. Plan Ahead to Avoid Last-Minute Costs

The key to finding affordable parking is planning. Waiting until the last minute often leaves you with fewer options, which may lead to paying premium rates or settling for unsafe locations.

- Use Parking Apps: Apps like Trucker Path, Park My Truck, and Pilot Flying J can help you find nearby truck parking in advance. Many also include reviews and availability updates from other drivers.

- Check with Shippers and Receivers: Some facilities allow overnight parking for drivers delivering or picking up loads. Always ask when you confirm your appointment.

- Avoid High-Traffic Times: Arriving early to truck stops or rest areas increases your chances of snagging a free or low-cost spot before they fill up.

2. Leverage Free Parking Options

While paid parking may sometimes be unavoidable, there are plenty of free options available if you know where to look.

- Rest Areas: Many state-run rest areas provide free parking for truckers. However, be cautious about availability, as they can fill up quickly.

- Retail Parking: Some retailers like Walmart or Home Depot may allow overnight truck parking in their lots. Be sure to check for posted restrictions and get permission before parking.

- Industrial Zones: Industrial parks and warehouse areas often have street parking available. These locations are typically less crowded, but always prioritize safety and local parking regulations.

3. Consider Monthly or Subscription-Based Parking

If you frequent specific areas, consider investing in a monthly parking pass or subscription service.

- Monthly Lots: Many parking facilities offer discounted rates for long-term or regular users.

- Membership Programs: Programs like Reserve-It from Pilot Flying J allow drivers to reserve parking spaces in advance for a fee, offering convenience and reliability.

- Yard Sharing: Some trucking companies rent out unused space in their yards for affordable parking. Look for listings online or through local trucking groups.

4. Use Company Resources

If you’re an owner-operator or leased to a carrier, don’t forget to check if your company provides parking solutions. Some carriers have dedicated lots or partnerships with facilities that offer free or discounted parking.

5. Prioritize Safety in Every Parking Decision

Affordable parking isn’t worth the savings if it puts you or your cargo at risk. Always prioritize safety when choosing a parking spot.

- Well-Lit Areas: Choose locations with good lighting and visibility to deter theft and vandalism.

- Secure Facilities: Paid lots often offer added security features like cameras, fencing, and staff on-site, which can provide peace of mind.

- Stay Alert: Even in safe locations, keep your truck locked, valuables hidden, and yourself aware of your surroundings.

6. Budget for Parking Expenses

Include parking costs in your operational budget to avoid unexpected financial strain. While free options are great, paid parking may occasionally be unavoidable, especially in high-demand areas.

- Track Expenses: Use an app or spreadsheet to monitor parking costs and identify patterns.

- Factor Parking Costs into Rates: When negotiating rates with brokers or shippers, consider the cost of parking for specific routes or loads.

While the search for affordable truck parking can be a challenge, a little preparation and resourcefulness can go a long way. By planning ahead, leveraging free options, and prioritizing safety, you can minimize costs while staying compliant and secure on the road.

Need a Financial Partner You Can Rely On?

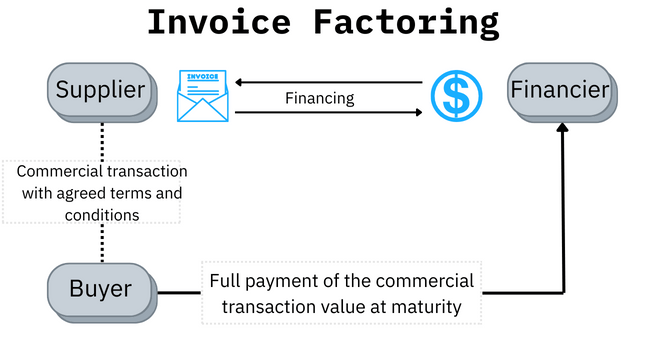

Managing parking expenses and other operating costs can stretch your budget thin. Altaas Factoring can help by turning your unpaid invoices into immediate cash, so you can cover your expenses and keep your trucking business rolling smoothly.Apply today with Altas Factoring and let us take the stress out of your cash flow—so you can focus on the road ahead!

VISIT US

HOURS

Monday - Friday

8:00am - 5:00pm MST

Closed All Major Holidays

We provide working capital to businesses in all 50 states.

Share On: