Per Diem Tax Deduction Tips for Truck Drivers in 2024

Maximizing Your Per Diem Tax Deduction: A Guide for Independent Truck Drivers

For owner-operators and independent truck drivers, managing tax deductions can be a game-changer in keeping more of what you earn. One of the most significant deductions available to truck drivers is the per diem tax deduction, which covers the costs of meals and incidental expenses while on the road. This deduction can make a substantial impact on your taxes, but understanding the rules is essential to get the maximum benefit.

In this guide, we’ll break down what the per diem tax deduction is, the current rates, and essential tips for keeping compliant with IRS requirements.

What is the Per Diem Deduction?

Per diem (Latin for “per day”) refers to a daily allowance that truck drivers can deduct from their taxes for meals and incidental expenses while away from home. It helps drivers cover costs incurred during long-haul trips that require an overnight stay, as opposed to short trips or local hauls where they return home the same day.

As an independent contractor or owner-operator, you’re eligible to claim this deduction as a way to offset the costs of food and incidentals that you otherwise wouldn’t incur if you were working closer to home. However, if you’re a W-2 company driver, recent tax law changes under the Tax Cuts and Jobs Act mean that you are no longer eligible to claim per diem deductions.

Understanding the 2024 Per Diem Rates

Per diem rates are set by the IRS and can vary based on whether you’re traveling domestically or internationally. For 2024, here’s how the rates are structured:

- Domestic Rate: For trips within the continental U.S., the per diem rate effective October 1, 2024, is $80 per full day and $60 per partial day. However, since only 80% of the rate is deductible, the actual deduction amounts to $64 per full day and $48 per partial day.

- International Rate: For travel outside the continental U.S., the per diem rate is $86 per full day and $64.50 per partial day, which translates to deductible amounts of $68.80 and $51.60, respectively.

When calculating your per diem deductions, keep in mind that from January 1 to September 30, 2024, the domestic rate was $69 per day, requiring a split calculation when filing your taxes.

Qualifying for Per Diem Deductions

To qualify for per diem deductions, drivers must meet specific criteria outlined by the IRS:

- Away from Tax Home: You must be working away from your “tax home,” which the IRS defines as the area where you earn the majority of your income. This usually means being on the road for an extended period, typically requiring an overnight stay.

- Duration of Stay: You must be away for a period that extends beyond a regular workday and requires rest (an essential sleep or rest break) to meet the demands of the work.

- Partial Days: For the days you depart and return home, you’re only eligible for a partial per diem allowance (75% of the full day rate).

If you meet these conditions, you can claim the deduction for each qualifying day you’re on the road. Local drivers who start and finish at home on the same day typically do not qualify.

Tax Home Requirements

The IRS requires truck drivers to have a defined “tax home” to claim per diem deductions. To establish a tax home, you must meet two of the following three criteria:

- Work Conducted Near Home: You perform part of your business in the area of your main home.

- Duplicate Living Expenses: You have living expenses at your main home that you duplicate while away for work.

- Frequent Use of Your Home: You have a family member living in your primary home, or you frequently return there.

If you satisfy at least two of these criteria, you can establish a tax home, making you eligible for per diem deductions when you’re on the road.

Tips for Maximizing Per Diem Deductions

- Keep Accurate Records: Detailed records of your travel days are essential for claiming per diem deductions. Use your ELD (electronic logging device) to track your hours of service, which provides valuable time and location data that can help substantiate your claim.

- Use a Per Diem Tracker: Many accounting apps are designed specifically for truck drivers to help track days away from home. These trackers can automatically record full and partial days, making tax filing much easier.

- Separate Business and Personal Days: Only count days that are for business purposes, not personal travel days, and keep records of any personal stops or stays outside of working hours.

- Consult with a Tax Professional: Given the changing rates and rules, working with a tax professional familiar with trucking can help you avoid mistakes, maximize your deductions, and ensure compliance with IRS rules.

Why Track Your Per Diem Deductions?

Failing to properly document and calculate per diem deductions can lead to missed savings or potential issues with the IRS. By staying on top of these records, you can significantly lower your taxable income, which reduces your overall tax burden. Additionally, because the per diem rate changed midway through 2024, tracking the exact days for each rate is essential to avoid confusion when filing.

Common Mistakes to Avoid

- Claiming Full Days for Partial Trips: Only claim the partial rate (75% of the daily allowance) on departure and arrival days.

- Overlooking Documentation: Without records from your ELD or other reliable tracking method, it’s difficult to substantiate your deductions if audited.

- Ignoring Rate Changes: For 2024, remember to calculate different rates for days before and after October 1 to get the correct deduction amount.

The per diem tax deduction is a valuable tool for reducing taxable income, helping truck drivers save money each year. By keeping accurate records, staying informed about rate changes, and understanding IRS requirements, you can take full advantage of this deduction. Remember, effective tax planning is part of a successful trucking business, and proper use of per diem deductions is a crucial part of that.

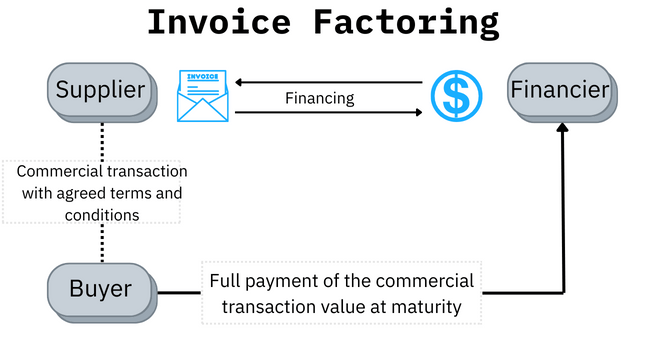

If you’re looking to optimize your finances beyond tax season, our factoring services are here to help. We offer fast, reliable funding solutions tailored for truck drivers, making it easier to manage cash flow, cover expenses, and keep your business running smoothly on the road. Reach out today to learn more about how we can support your financial journey.

VISIT US

HOURS

Monday - Friday

8:00am - 5:00pm MST

Closed All Major Holidays

We provide working capital to businesses in all 50 states.

Share On: